- Europe has steadily built resilience over the past decade, while the US has been losing its way fiscally and politically

- Europe’s valuation seems too cheap to us given the quality of its companies

- After several years of performing poorly, selective quality stocks are back at interesting valuations

- Dividend strategies look well positioned

- Forget the narratives of why, Europe is too cheap relative to the US to ignore

Introduction

Over the past decade, Europe has made remarkable strides in strengthening its economic resilience. Through better crisis management tools, structural reforms and banking sector improvements, the region has navigated major shocks, including the Covid-19 pandemic, the Ukraine-Russia war and a rapid ECB tightening cycle. Despite these achievements, valuations have remained subdued, held back by weak sentiment.

There are signs that Europe is changing and there are many things that Europe still can and should do: Europe needs less discussion about the Draghi report on European competitiveness and more action implementing it. While the potentially hostile environment of Trump tariffs and Russian aggression may look daunting, these common external enemies should prove useful to motivating change in Europe. Previous taboos around extreme green and fiscal stances are being challenged. Germany looking to use fiscal policy more is long overdue – the economy has been very weak for a sustained period. The EU easing emissions targets for the automotive sector is just one example of the need for more pragmatic policymaking. It tends to take major events to turn sentiment that gets excessively bullish or bearish towards the end of these relative performance regimes. The events of the past five years seem to fit the bill.

In contrast to the first Trump term when the S&P 500 performance seemed constantly in presidential focus, there is a change in tone this time. Recent commentary from the US administration has focused on prioritising “Wall Street over Main Street”, the need to move the economy from public spending to private sector activity for an economy in transition. The degree of political polarisation in the US disguises the fact that it is the combination of both the Trump and Biden presidencies that has produced the US fiscal challenges today. Trump’s first term tax cuts broke the historical role of fiscal deficits as counter-cyclical tools and were only used when the economy was weak. The Biden administration then spent too much in the aftermath of Covid with record fiscal deficits outside a recession.

Unlike a decade ago when Europe dominated political dysfunction (Eurozone crisis then Brexit), political and geopolitical uncertainty has since risen everywhere. The rest of the world becoming more dysfunctional may not be the most uplifting message, but it is materially relevant for making the relative case for Europe.

Markets are seeing a big reversal in the trends of recent years as it becomes clearer that the Trump second term looks set to disrupt the factors that underpinned US outperformance.

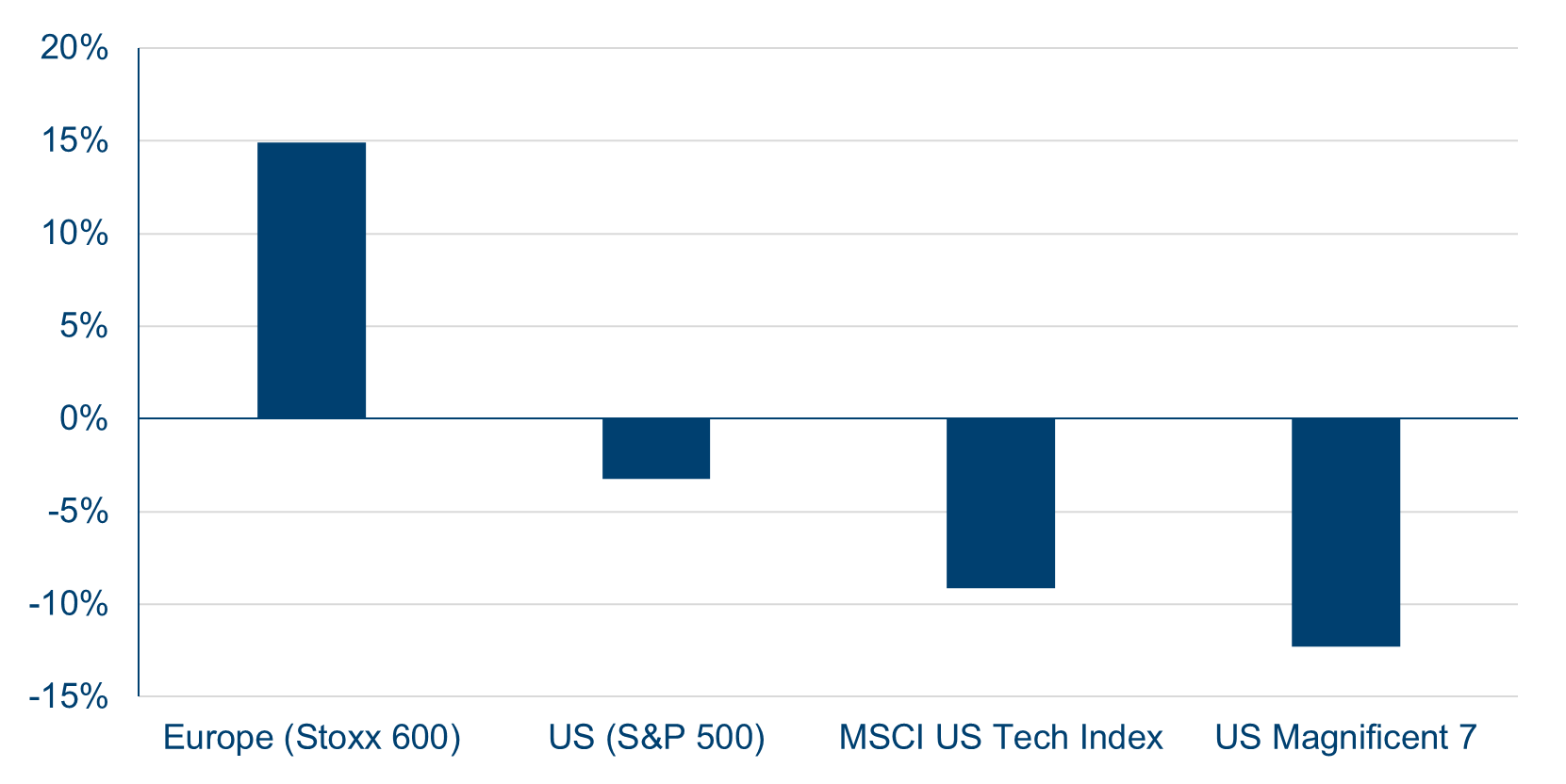

| Year-to-date performance (in dollar terms) |

|

| Source: Polar Capital and Bloomberg; 31 December 2024 to 17 March 2025. |

Europe seems too cheap given the quality of its companies

The recent improved European stock market performance looks like a turning point to us. The key point for us is compelling relative and absolute starting valuations. Narratives about changing macro factors are a catalyst for the extreme valuation discount to narrow. Having seen a five-year period that was generally challenging for contrarian investors (first because of Covid winners and then because of AI winners dominating market excitement), we now see an environment that is much more promising for those like us who invest away from the crowds.

Within financials, our global reinsurance holdings (Munich Re, Swiss Re and SCOR) and Zurich Insurance Group (a leading global non-life insurer) have performed strongly over the past 18 months. Our selective telecoms holdings (Orange, Tele2, Koninklijke KPN and NOS SGPS) have also started to perform much better over the same timeframe as their outlooks improve. In recent weeks, our holdings in global beer leaders (Carlsberg and Heineken) have performed strongly. We still see plenty of upside in all these areas. The common thread here is defensive stocks that simply became too cheap relative to their steady performance.

We are also keen on quality laggards that reached extreme valuations in 2020-21 due to very low bond yields driving reratings but have since steadily come back to earth. Stocks we have been able to buy in the past year include Kone (global lift business), Amadeus IT Holding (global travel IT leader) and FinecoBank (Italian digital bank), and more recently we saw a corrected valuation in Novo Nordisk (global diabetes and obesity leader).

Another part of the market looking cheap is infrastructure – we have several holdings that appear to show very solid growth and income prospects over the long term, but are currently cheap as they are seen as bond proxies. These include Getlink (Eurotunnel), INWIT (Italian telecom towers) and Vinci (global infrastructure).

Europe has a reputation for being an open region for global trade and a winner from globalisation. When assessing Europe as an investment opportunity it is important to note that companies and indices are distinct from countries and regions. Across the companies in our portfolio, we are confident that the direct effect of tariffs looks to be modest. Tariffs may have an indirect effect, if a slowdown across global markets emerges or if Chinese currency devaluations occur. These indirect effects lead us to be more cautious about cyclical companies. We always have a preference for quality cyclicals such as Bureau Veritas (testing and inspection) over deep value cyclicals such as automotives. Indeed the latter look distinctly poorly positioned for the current challenges.

Our investment process seeks to identify companies that can make a 10% return on equity through the cycle. We like returns on equity as a proxy for quality – there has to be some strength to a business model to meet this criteria if financial leverage is reasonable. We believe the portfolio companies’ returns on equity look very good versus the European market. They also look reasonable when compared to the US market which makes their discount to the US unwarranted, in our view.

| Portfolio returns on equity - Europe versus the US |

|

| Source: Polar Capital and Bloomberg; 19 March 2025. |

We like selective quality value

Quality stocks have performed relatively poorly over the past five years. However, their rolling five-year performance is now back in line with that of the overall market as their peak valuations have steadily unwound over the past three years. Historically, quality stocks have performed better prospectively when they are less loved (i.e. have only performed in line with the market over the previous five years). While some stocks, such as SAP, continue to look very expensive to us, we have been finding selective quality value ideas in these ’derated quality’ stocks over the past year.

| Europe quality stocks are more compelling again Rolling five-year total return for MSCI Europe Quality and Stoxx Europe 600 indices |

|

| Source: Polar Capital and Bloomberg; 17 March 2025. |

Dividend strategies look well positioned

The strength of an equity income strategy is that defensive equity dividends provide both a dividend today and growth over the medium term. Our investment strategy is not focused on companies with flat dividends but instead on those companies that provide a dividend and capital growth. Equity yields are more attractive than cash and government bonds, in terms of pricing and purchasing power, over the medium term.

Our simple pitch is that our Fund offers a positive real starting yield with a track record of real growth since inception despite Europe’s lost decade of weak earnings and the Covid dividend rest. The low risk and consistent nature of our investment process gives us confidence that our approach can deliver strong medium-term savings outcomes.

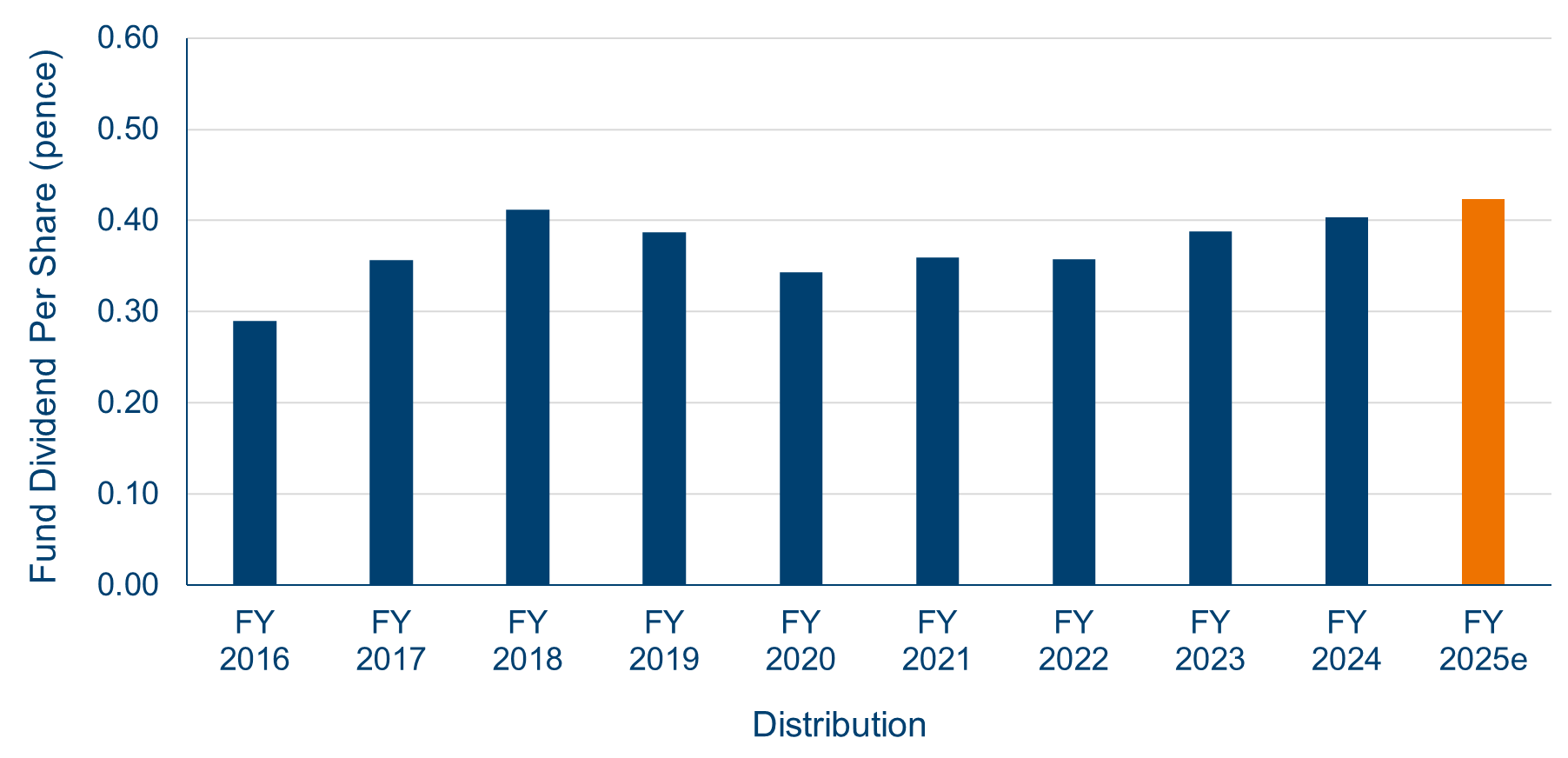

| Polar Capital ex UK Income Fund dividend track record - Class I GBP distribution 4.3% CAGR 2016-25e |

|

| Source: Polar Capital and Bloomberg; 19 March 2025. Estimates contained herein are for illustrative purposes only and are not guaranteed. Investors should note that historic yield does not measure the overall performance of a fund. It is possible for a fund to lose money overall but to have a positive historic yield. Historic yield cannot be considered as being similar to the interest rate an investor would earn on a savings account. |

Our dividend approach is versatile, offering both the benefits of income generation and the potential for strong total returns. We focus on identifying stocks that can deliver at least 10% total shareholder return (TSR) annually, combining dividend yield and earnings growth. Stocks with higher dividend yields are targeted when undervalued (with a free cashflow yield of at least 4%) and are expected to generate strong earnings growth. For instance, a 2% dividend yield requires 8% earnings growth to reach 10% TSR, while a 6% yield would need 4% earnings growth. The goal is to buy these high-yield, undervalued stocks and sell them once their yields compress as they become fully valued, rotating proceeds into new high-dividend ideas to drive both dividend and capital growth over time.

Europe has simply become too cheap relative to the US

We think there are several reasons why markets may look to continue to unwind the US equities wide premium over Europe. However, the key underlying factor is relative valuation.

The discount in valuation of Europe versus the US reflects the bifurcation between the US and the rest of the world. In our view, this cheap valuation of Europe represents a key opportunity for investors, especially those looking beyond the US. In Europe there are many strong investment opportunities, central to which is an attractive starting valuation and the ability to compound over the medium term. Europe’s blue chip companies combine both attributes.

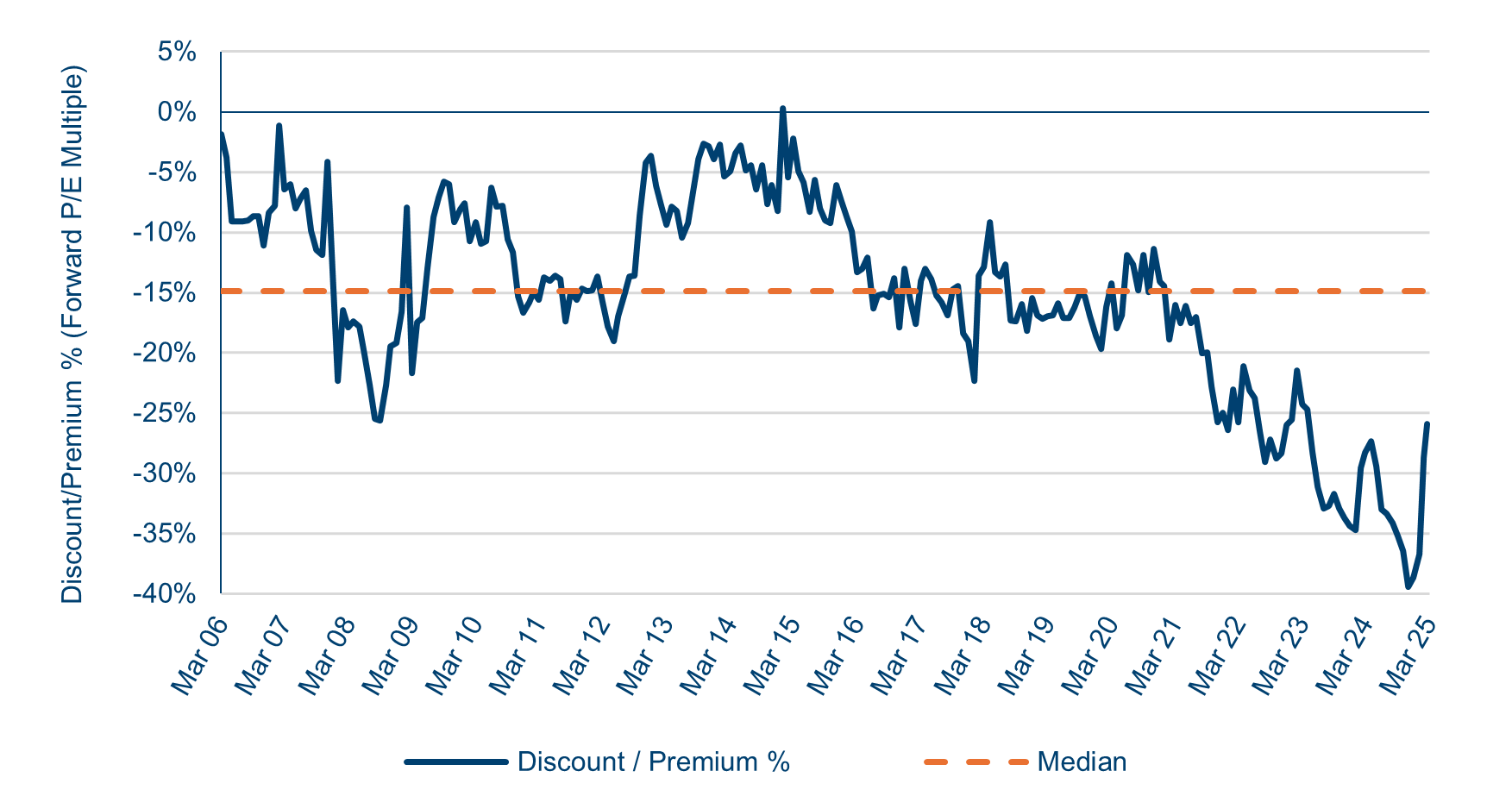

| Europe still trading at a material discount to the US Europe (MSCI Europe ex UK) versus US (S&P 500) forward P/E multiples |

|

| Source: Polar Capital and Bloomberg; March 2025. |

We think it is encouraging that despite Europe’s indices starting to perform better, valuations remain modest historically. There is plenty of room for European markets to run. Investors who have been underweight should not feel they have missed the boat.

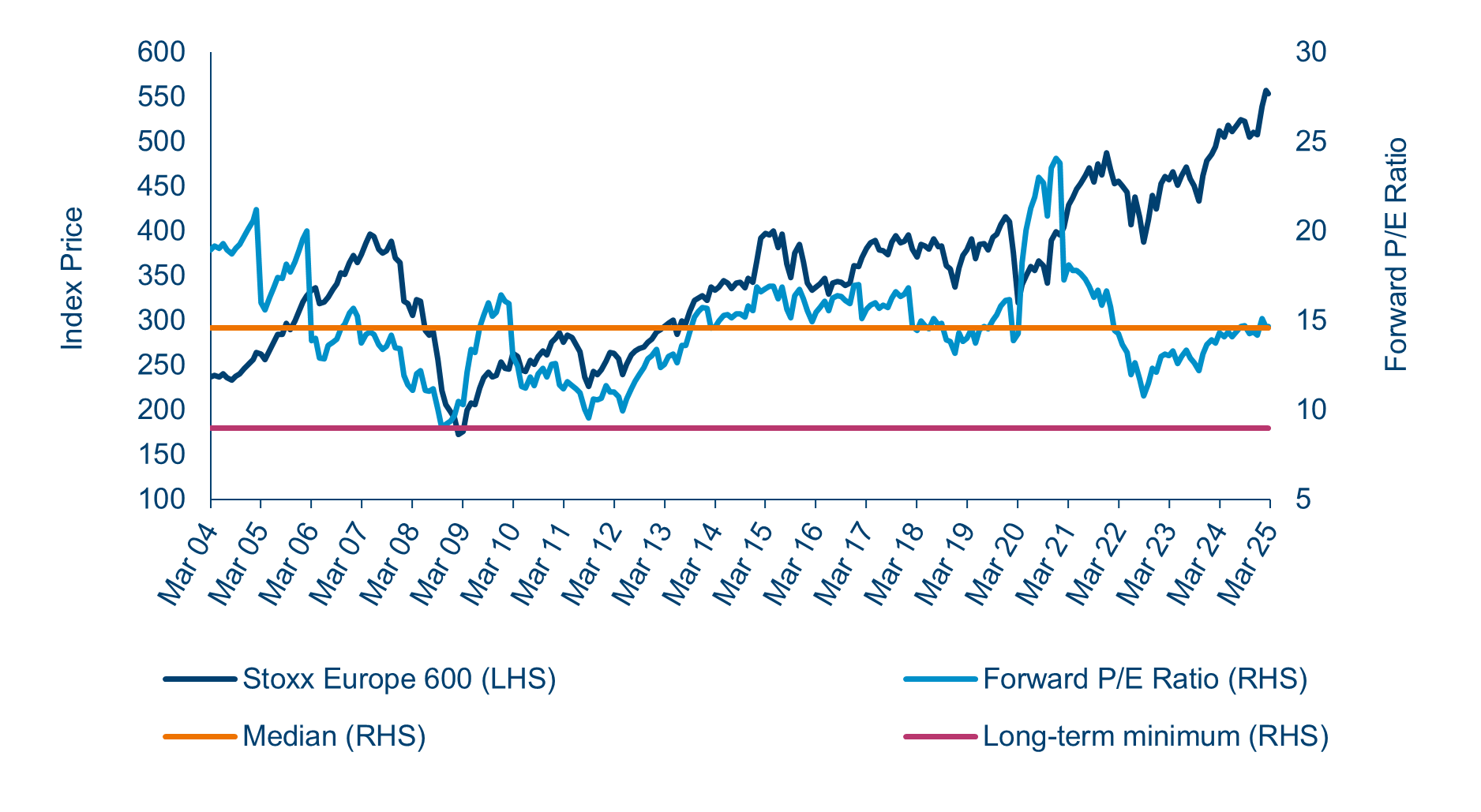

| Europe at record highs and trading at an average multiple Europe (Stoxx 600) index price and forward P/E multiples |

|

| Source: Polar Capital and Bloomberg; March 2025. |

Conclusion

The high degree of uncertainty across macroeconomics and geopolitics points to now being a time for investors to reassess the degree of their overexposure to the US. We see a strong case for Europe as a very good alternative. European equities offer plenty of good companies at very attractive starting valuations. There is justified excitement around Europe being forced to finally move more growth-friendly (German fiscal stimulus; Draghi report reforms). The starting valuations of many defensive stocks are so cheap that we would be confident in making money in these assets even if change takes time to play out in Europe.

The relative winners and losers are less clear going forward and this should direct asset allocators to more balanced portfolios. Our conclusion is simple – it is time to be more positive about Europe.