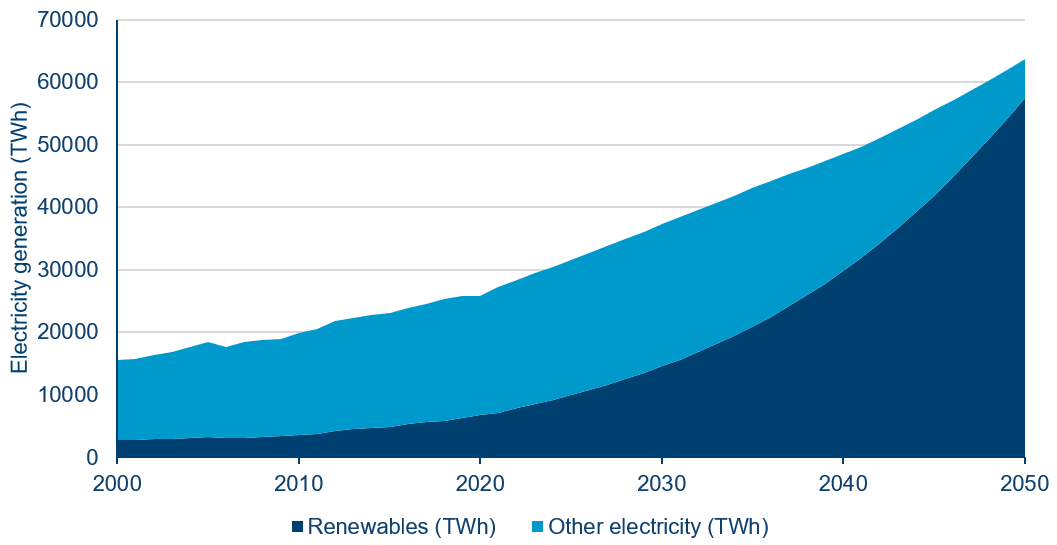

The electrical grid is going through a revolution. Deindustrialisation over the past 20 years in western economies, coupled with the rise of energy efficiency, have depressed electricity demand in Europe and the US. However, current trends like electric vehicles (EVs) and data centres are driving that demand higher, with our estimates predicting that these markets will return to growth, driving the global electricity generation to grow by 2.5x from 2020 to 2050, a 3% CAGR.

A major knock-on effect is that, being accustomed to a flat and stable markets for years, operators and regulators of the grid now face higher demand while dealing with less predictable supply as well as an ageing grid. This is because electricity generation is moving from central dispatchable units (fossil fuel plants) to distributed intermittent ones (renewables).

All this will require a tremendous overhaul and expansion of an undersized and outdated grid system.

| Electricity demand drivers are set to put pressure on grid infrastructure |

|

| Source: IEA1 for figures until 2020, Polar Capital estimates as at April 2023. |

Thanks to our flexibility to invest along the whole smart energy supply chain, we have the opportunity to tap into, and benefit from, the seismic shift thrown up by this imminent need to ready the grid for a sustained uptick in usage.

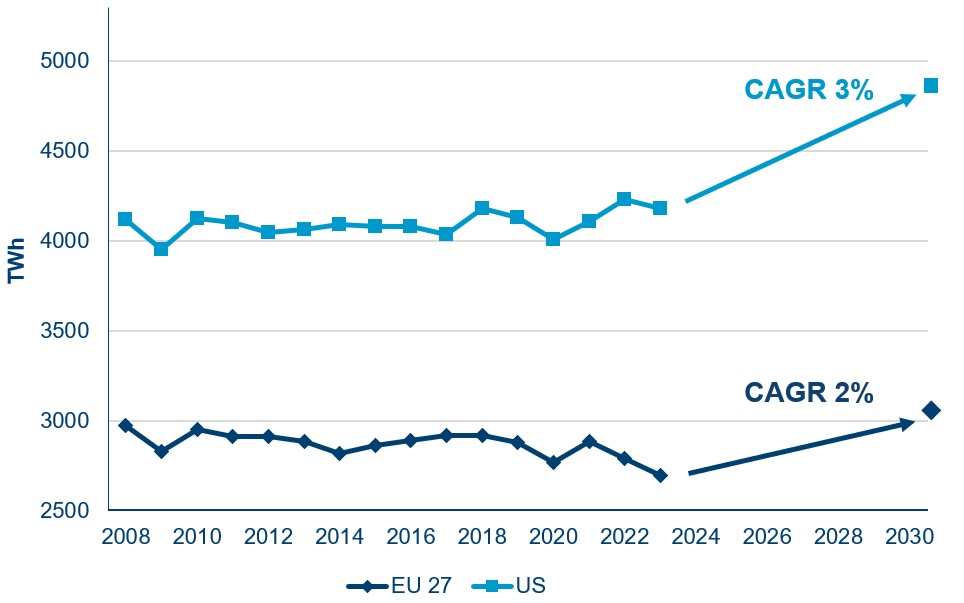

New challenges facing the electrical grid

While the electrical grid has changed very little since its beginnings around the start of the 20th century, it must undergo significant transformation to make it viable for the 21st century. The decline in electricity demand in western economies is particularly striking in the UK, dropping by 21% between 2008 and 2023. This decoupling from economic growth, which is also apparent across Europe and North America, is due to the shift to a service-led economy and the rise of energy efficiency as well as higher energy prices.That decoupling, however, is likely to reverse soon in both Europe, where we forecast a 2% electricity demand growth CAGR 2023 to 2030 and the US, where we forecast an even stronger 3% CAGR growth.

| Electricity demand in Europe and the US (2008-2030) |

|

| Source: EMBER2 for figures until 2023, Polar Capital estimates as at May 2024. |

This increase in electricity demand expectations is linked to already existing trends such as EV adoption and building electrification, for example, with wider use of heat pumps for heating and cooling as well as new developments, such as the recent rapid adoption of artificial intelligence (AI) and the increased load from dedicated data centres. AI data centre rack power needs could be up to 7x higher than traditional data centre racks. We estimate global AI workload-related electricity demand will exceed the electricity consumption of the UK by 20273, with a faster deployment in the US than Europe explaining our higher electricity demand growth expectations for the US.

Additionally, climate change and cybersecurity are two emerging threats to grid operations. Heatwaves, wildfires, cyclones and floods have already led to a rise in weather-related outages and equipment damage. Finally, while critical for reaching decarbonisation targets, the rapid development of renewable electricity can lead to instabilities in specific regions when the penetration reaches higher levels. Some network operators are handling high amounts of intermittent energy without disruptions but this requires much higher levels of real-time grid knowledge and control, which is only achievable with modern connected solutions. This also means the grid of the future needs to be increasingly resilient and instead of a traditional centralised architecture there will have to be an interwoven structure allowing increasing system robustness.

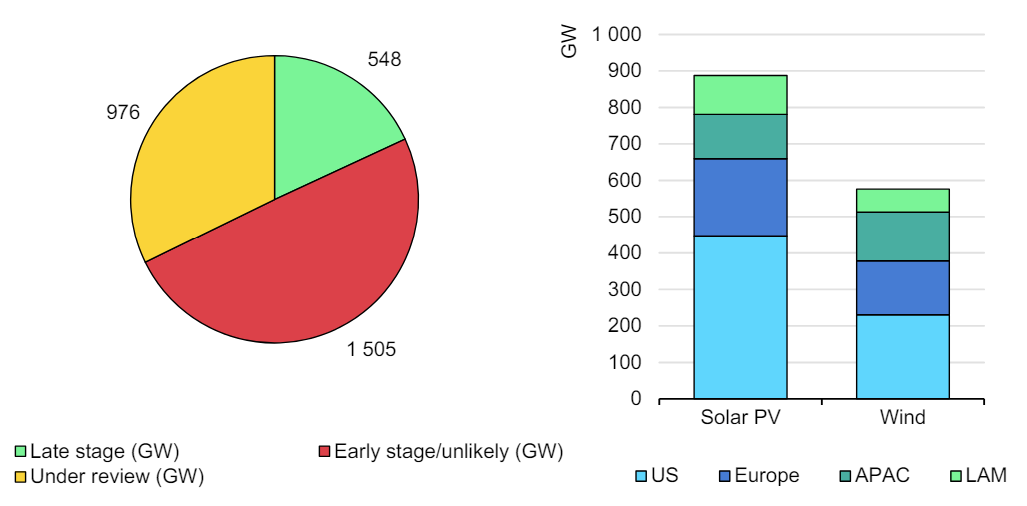

These challenges require an urgent acceleration in the rollout of new capacity, which the current regulations and permitting restrict. Overall lead times for new transmission lines are typically over five years in western markets and can reach much higher levels (Südlink, Germany: 2014-26; Bay of Biscay, France-Spain: 2017-28; Sunzia, US: 2006-23). This has led to a bloat in the grid-connection queues for the new capacity of renewables.

| Renewable energy capacity in connection queues by project stage (left), and advanced-stage solar PV and wind projects by region (right) |

|

| Source: IEA4. |

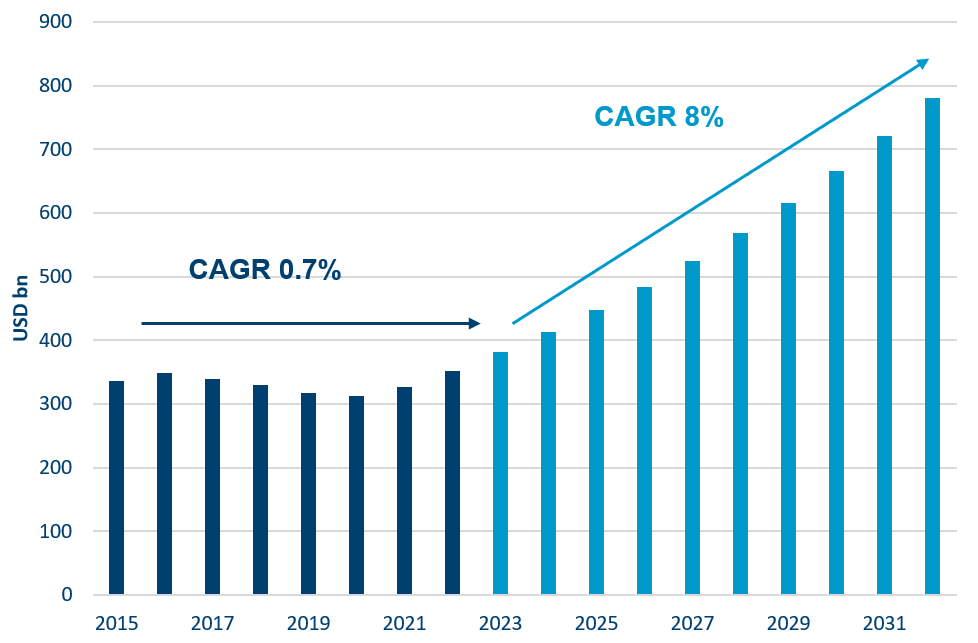

Grid investments offer opportunities for stock pickers

Electrical grid equipment providers are one of the first positively impacted segments, with global annual electrical grid capex expected to grow from $352bn5 in 2022 to $781bn6 in 2032, or an 8% CAGR.

| Global electrical grid investments to increase 2.2x by 2032 |

|

| Source: IEA7 for figures until 2022, Polar Capital estimates as of May 2024. |

Advanced cable manufacturers are seeing ever-higher demand for their products. High voltage direct current (HVDC) cables allow the transmission of electricity of much higher power and at lower losses and are better suited to maintain synchronicity across different networks. They are therefore perfectly positioned, in our view, to benefit from the interconnection of different markets and for moving large quantities of electricity, for example Baltic sea offshore wind to central Europe.

Direct current (DC) networks would also be a critical underlying future structure for an interwoven continental grid, superposed with a local alternating current (AC) grid, which would increase flexibility and resilience. Only a few industrial actors are able to provide customers such solutions with a handful of global players sharing the market. Grid operators in Europe have already significantly increased their planned spending for the next few years, with an acceleration of investments from 3.8% 2023-26 CAGR to 8.1% 2026-308 leading to record orders and backlogs at cable manufacturers.

Another critical component of the expansion and updating of the electricity network is transformers. These adjust voltage and are therefore present throughout the grid, from the point of generation to the point of consumption. The demand is already expanding so fast there has been a shortage of key equipment, leading to lead times of more than two years in some cases. The manufacturers of these products are specialised and benefit from a rise in average selling price and positive order visibility.

Finally, as these hardware deployments face bottlenecks, we expect grid enhancing technologies to quickly develop as they present a more rapid and flexible fix to network congestion issues. These solutions focus on fully exploiting the capacity of the existing grid and range from data connectivity to broader use of demand response. For example, simply measuring the temperature of a transmission line (the hotter it gets the more it sags which can become dangerous) can allow the operator to optimise power throughput and deliver up to 30% more electricity. Additionally, we also expect to see the emergence of virtual power plants by aggregating the storage capacity of EVs connected to the grid. Finally, all these solutions are integrated and their positive effect compounded by the use of advanced grid software solutions.

The Polar Capital Smart Energy Fund has meaningful exposure to companies addressing the smart buildout of the electrical grid, from operators of electrical networks to manufacturers of equipment like transformers and cables and including software providers.

1. https://www.iea.org/data-and-statistics/charts/investment-spending-on-electricity-grids-2015-2022

2. https://ember-climate.org/data/data-tools/data-explorer/

3. AWS, Schneider Electric, Polar Capital estimates. Smart Energy: Powering the AI revolution | Polar Capital

4. https://iea.blob.core.windows.net/assets/96d66a8b-d502-476b-ba94-54ffda84cf72/Renewables_2023.pdf

5. IEA, https://www.iea.org/data-and-statistics/charts/investment-spending-on-electricity-grids-2015-2022

6. Polar Capital estimates as at May 2024

7. https://www.iea.org/data-and-statistics/charts/investment-spending-on-electricity-grids-2015-2022