We run a single-sector Fund but it is important not to be focused too narrowly on our own fiefdom while ignoring what is happening in other areas. Changes in technology and artificial intelligence (AI) impact all industries but to different degrees and in different ways. As we write, Big Tech is receiving ever more plaudits and driving even more market returns as investors seek to capitalise on ongoing disruption and adoption across many industries. However, we believe their impact on non-life insurance will be muted or most likely, in our view, a positive as we have already seen many favourable use cases across our companies. Insurance demand is driven by ever-rising risk and society’s increasing desire to avoid volatility. As good as the Big Tech companies are, we do not think they are going to take risk out of the world anytime soon. Rather, we expect to see accelerating demand for insurance in a riskier, changing and ever more complex world.

The accelerating pace of disruption is taking place against elections which are blurring the political landscape, rising geopolitical tensions (including multiple wars) and continual reminders of Mother Nature’s own risks from earthquakes, tornadoes and wildfires to floods. In contrast to Big Tech’s growing shadow over many parts of the economy, we believe our companies are well positioned to capitalise on AI and machine learning innovation. We expect this will likely widen further their underwriting moats and drive a continuation of the long-standing significant outperformance of the industry as a whole which has commanded only mediocre results over time.

Around 7-8 years ago we started to see the emergence of InsurTech companies, our equivalent to what the banks were seeing with FinTech. We attended many conferences and participated in a number of startup accelerator programmes to get a robust view of what disruption, if any, might await our industry. We saw something very different to what the banks where seeing with their FinTech disruptors. InsurTech startups tended more to partner with incumbents as even if they had some ‘cool’ new product or customer engagement app, ultimately they always needed a strong and regulated balance sheet to offer their product. In recent years, we have seen a handful of InsurTech IPOs which have not been a great success. Ultimately, we did not see much disruption then and we do not think we will see any great disruption now, even with the new generation of AI-led Big Tech innovations as it takes many years to build the data sets required to empower these models.

We have previously argued that the insurers themselves are the original data companies. It is an insurer’s ability to slice, dice and price risk and the underwriting margins that follow that we believe is the ultimate differentiator in performance. That is because the other key profit driver, investment returns, are broadly similar across the non-life industry as insurers need to keep their balance sheets dull and boring, with plenty of cash and short-term bonds, that gives them the liquidity they need to pay claims that can happen at any time.

Rather than all-out disruption, AI and machine learning add an interesting new element to the insurer’s toolkit for better underwriting, better data and improved profitability by:

- Improving underwriting: Generating insights from large, complex data sets to augment decision-making and inform pricing

- Enhancing claims processes: Including better triaging and enhanced use of parametric products or risk management solutions to help lower the cost of insurance

- Reducing expenses: Automating repetitive knowledge tasks such as policy issuance or claims notifications

As Evan Greenberg, CEO of Chubb, said in his 2023 letter to shareholders: “AI presents an extraordinary opportunity for us to unlock and maximise our rich trove of data to accelerate innovation, expand capabilities and bolster competitive differentiation. By exploiting our data as a strategic asset across multiple lines of business, geographies and products, we are advancing our ability to materially outperform through improved risk selection, pricing, portfolio management and operational efficiency.”

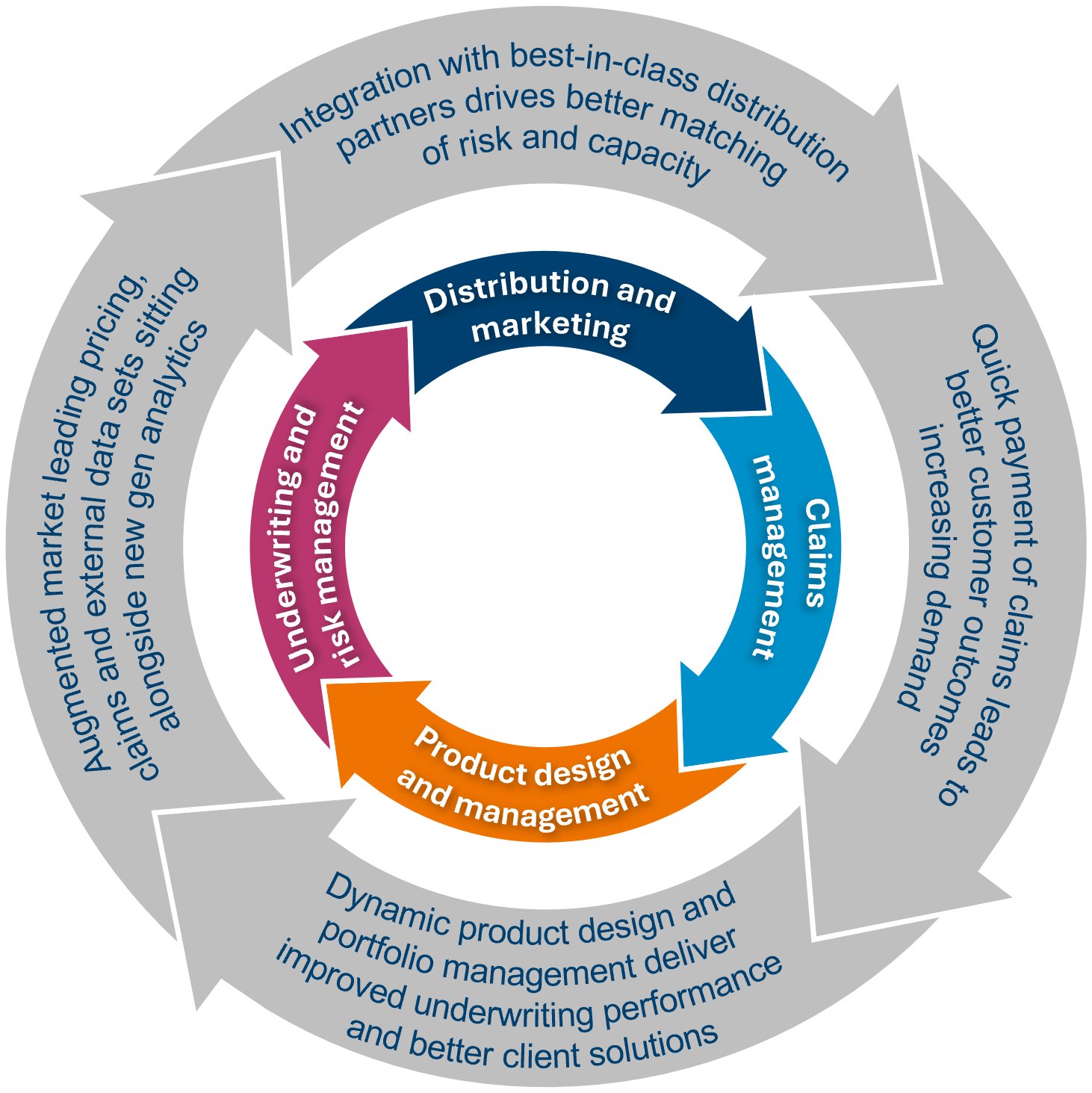

There is a great deal of value in the claims data an insurance company has. It is not something a competitor or new entrant can buy off the shelf so a company with those data sets is in an excellent position. With the right technology, mining that data to discover insights previously not thought about is a considerable advantage. These new insights can be beneficial across all the different parts of the underwriter’s value chain. A good insurer continually improves their underwriting process by learning from one aspect of what they do and using it to improve another. This ‘flywheel effect’ (see below) was developed by Jim Collins and explained in his book Good to Great. He talks about the importance of every single aspect of the flywheel – the value chain – feeding and driving every other aspect. In insurance, where you do not know your cost of goods sold up front, this carries particular resonance.

|

In terms of the improved claims management we mentioned earlier, if that is not feeding directly into the underwriting and risk management process then a huge opportunity is being missed. By the same token, distribution and marketing should feed directly into claims management, for which some of our portfolio companies are developing very impressive tools.

Case study: Travelers Travelers is a US-based property liability insurer with one of the largest drone fleets in the US and the largest in the insurance industry, with over 700 Federal Aviation Administration (FAA) certified drone pilots. Their geospatial insights are key to their market-leading claims solutions, leveraging 45 billion claims data attributes as well as those of external partners. Satellite and drone-powered imaging evaluates damage severity post-event, triages customers and makes an initial estimate of a claim in days. The company drives significant efficiencies, particularly in how they pay claims. For example, if a town is hit by a tornado, the likelihood is that the police are going to cordon off that town. Travelers is able to fly in drones that can map the roofs, procure any new parts needed and provide better solutions faster. Other firms may have to wait to be able to send their claims adjusters in to climb up ladders onto the roofs before their claims process can properly begin. Bringing together natural language processing with satellite and geospatial tools gives the likes of Travelers the ability to improve their product design and management. |

Other examples include:

- Beazley, a UK-based insurer, focuses on having technological innovation within their product set enabling them to provide better underwriting and risk management for real world problems. In addition, they combine this with a claims ecosystem incorporating risk prevention that differentiates them from their peers.

- Intact, a Canadian business, has been a pioneer in technology development and AI. They have a data lab in Hong Kong, complementing their capabilities with over 500 staff dedicated to machine learning across their organisation. They have over 300 active AI models generating real, tangible benefits and generate >$100m in recurring revenues.

- Chubb estimates about 80% of their data is unstructured and there is a huge opportunity here to use the capability to analyse unstructured data that AI brings to drive better underwriting, better ‘slicing and dicing’ of risk and, ultimately, better solutions for customers. Best-in-class underwriter Chubb has been using copilots for more than a decade.

AI will impact insurers differently

How AI is going to impact an individual insurer is highly dependent on where that company is on the risk spectrum as an underwriter. For more vanilla underwriting risks the impact of AI is likely to be seen through efficiency improvements as you already see in lines such as personal auto where underwriting margins can often be thin at an industry level. We expect that more of these simpler risks will undergo straight-through processing with pricing driven by algorithms and it will be only exceptions that need subjective judgements and are touched by a human underwriter. However, in contrast as soon as you start moving up the risk scale in commercial markets, and particularly into the more specialty markets where our companies tend to focus, AI becomes an underwriter’s go-to copilot as it is already for a number of our companies. AI will augment existing skills and help analyse risks that up to now have been more difficult to assess providing a better understanding and ability to price a policy. Insurers will also have a better understanding of risk aggregation which should reduce the potential volatility of underwriting profits. The impact of AI is not one-size-fits-all in terms of how it will impact each underwriter.

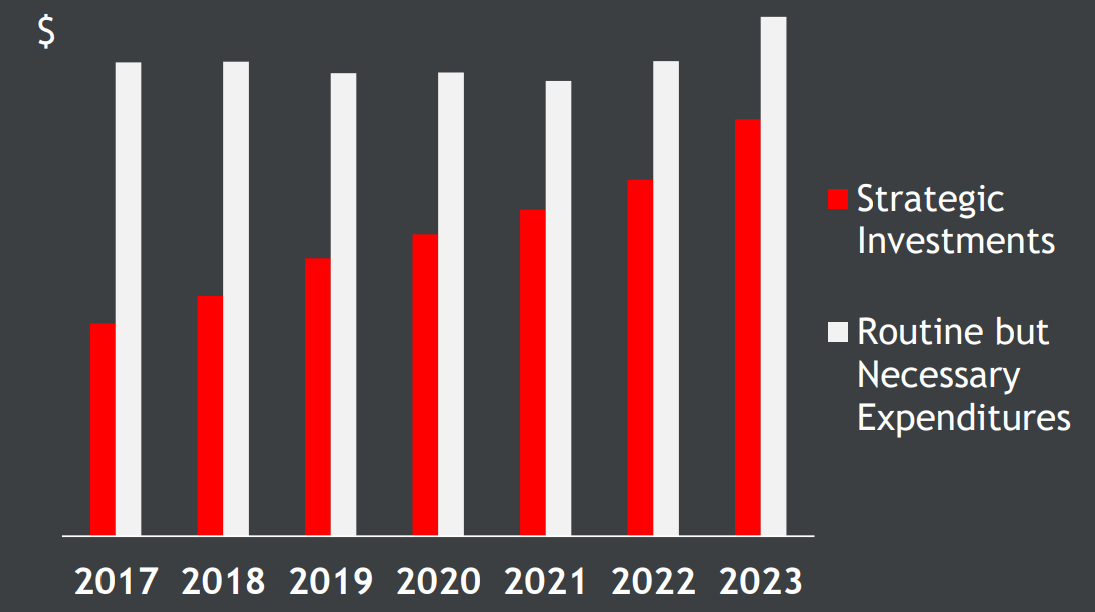

Once again, take Travelers as an example. The amount they have spent on technology has risen over time and is potentially going to widen the moat over their peers. Their technology spend exceeded $1.5bn in 2023 and will rise in 2024 with more strategic investments – they currently have 40 unique AI claims models running in real time, producing 750,000 recommendations annually.

| Growth in strategic technology investments drives AI | |

| |

| Source: Polar Capital, April 2024. Travelers 4Q 2023 earnings presentation; Travelers, 2023 shareholders’ letters and annual reports. |

Deep pockets are more important when it comes to personal, auto and home insurance, as AI is likely to accelerate scale benefits. Arguably, we are already seeing this at Travelers and Progressive, both long-term Fund holdings. For commercial lines (80%+ of the Fund) it is less about the absolute number of dollars available to spend on technology (in any case, many of these tools are relatively low cost) and more about having scale and expertise in a particular underwriting niche. It is about how you understand risk better than your competitors. For many of our companies, their claims data is likely to lead to a treasure trove of new insight. However, we are mindful that this data is inherently backward-looking and the world is changing, particularly on climate change and catastrophe risk. When you are underwriting the latter, supplementing insights from the past needs to be combined with also having a forward-looking view. This requires an ability to supplement your own internal data with leading-edge new data sets from a range of sources.

Insurance is a cyclical industry but it has never been one where everything is moving radically up or down together. Rather it is comprised of many little cycles with different lines of business moving in different ways. The best insurers anticipate these changes and are nimble enough to take advantage of them which is something the larger conglomerates naturally struggle to do. More data and better analytics have helped reduce the amplitude of cycle volatility given an underperforming business is spotted much quicker today than it was in the past. This means corrective action can be taken sooner leading to more steady and less volatile earnings over time. This could be rewarded with higher valuations by the equity markets in time.

Big Tech and AI are going to make significant changes to insurance underwriters – we expect AI capability to further augment underwriters’ toolkits and widen the already significant dispersion of quality across the sector. While other industries’ companies grapple with wholesale disruption in the face of AI, we see technology setting the stage for even more opportunity to sort the elite (re)insurance firms from the rest. The Polar Capital Global Insurance Fund has always focused on investing in the quality operators of the sector and we believe this will only become more important in the years to come.