An important characteristic of the approach behind the Polar Capital Artificial Intelligence Fund is to invest in the applications and beneficiaries of artificial intelligence (AI) across all sectors, not just AI-enabling companies themselves. This strategy sets us apart from peers which, we believe, could miss the opportunity for tremendous AI value creation beyond the technology sector. An example of where we have seen early signs of a competitive advantage begin to play out is in agriculture.

Precision agriculture: supporting the next wave of industrial revolution

The sector is no stranger to innovation. From early practices such as irrigation to the Roman plough to Jethro Tull’s seed drill in 1701, and more modern examples in powered machinery, hydroponics (cultivating plants without soil), pest management and genetic modification, new technology has consistently coincided with major shifts in farming practices, yields and population growth.

John Deere, known mostly for its tractor fleet, is a leader in the new economy of precision agriculture, using large amounts of data and autonomous machinery to improve farming efficiencies. Its fleet of “500,000 connected machines run across more than a third of the earth’s land surface”1, offering a wealth of data to support large model accuracy and provide real-time insights to farmers monitoring machinery and crops.

|

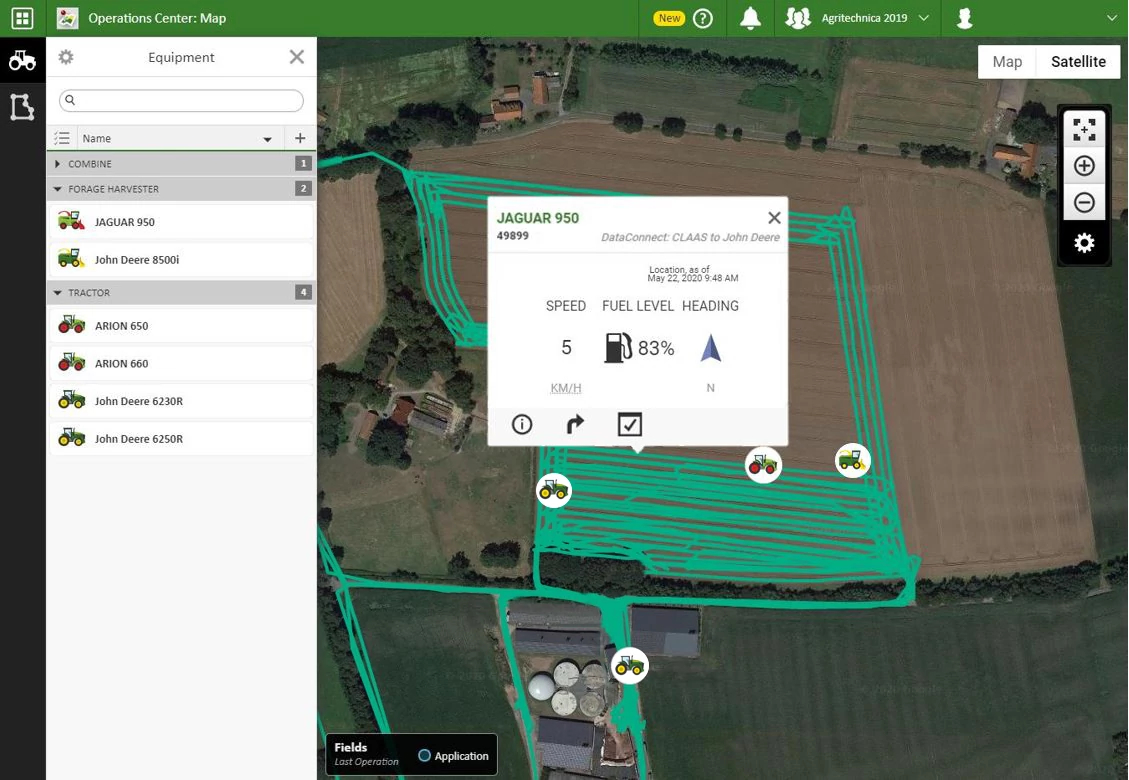

| John Deere Operations Centre. Source: John Deere. Accessed 1 July 2024. |

A sign of AI increasing product efficiency comes from the company’s Operations Centre. This virtual hub gives farmers a so-called ‘digital twin’, a virtual replica of a physical environment, allowing users to plan planting and harvesting seasons, create zones for more precise fertiliser application and program autonomous tasks across an entire land area.

Given the time commitment and expertise currently needed to manage farms, the average size of which sits at 88 hectares (ha) in England2, c188ha in the US3 and >1,000ha in western Brazil4, putting this control and accessibility in the hands of farmers marks a major step forward.

|

| Inside the Autonomous 8R Tractor. Source: John Deere. Accessed 1 July 2024. |

John Deere’s See & Spray product detects weeds among crops and targets them for spraying, helping farmers avoid blanket application and conserving stores of weed-killing herbicides. These chemicals have been in short supply in recent years, driving up costs for US farmers, whose average spend on agricultural chemicals grew by 20.2% from $8,884 in 2021 to $10,680 in 2022, according to the US Department of Agriculture5. Add in the launch of the company’s autonomous 8R tractor in 2022 and Deere’s nascent precision fertiliser unit, in a similar vein to See & Spray, and it becomes clear the company’s AI technology is playing a central role in helping farmers reduce costs, increase land control and plan more efficiently.

John Deere’s plans to deepen the firm’s AI use include working with NVIDIA to incorporate greater edge computing power and greater power efficiency, and partnering with satellite company Starlink to improve communication connectivity, allowing real-time intelligent farming and deploying spraying drones.

AI edge easing sector cyclicality

While performance in the agriculture sector has softened after a bumper 2020-2023 cycle, supported by the low cost of equipment financing, John Deere has continued to roll out its technology-enabled fleets, encompassing autonomy, digital and AI planning. This higher technology content is showing early signs of driving a faster equipment refresh cycle for farmers, better pricing power and higher margin products. These factors can combine to make the trough of the cycle shallower, meaning the company’s peak-to-trough earnings per share (EPS) decline is likely to be less significant than some fear compared to previous cycles. In our view, a higher ’trough margin’ profile with lower volatility should also be rewarded with a higher multiple.

John Deere expects price realisation to be positive this year despite volumes falling year-on-year – rare in a cyclical industry. Even if is only just taking the edge off at the margin in this downcycle, it prepares them well for 2025 and beyond as these technologies mature. They have targets for 10% of revenue to be recurring by 2030 which would be a big lift to the multiple because of the lower cyclicality and high-margin nature of software/data revenue. As a result, while we are conscious that the industry is currently working through a downcycle, we see reasons to be constructive when the next agriculture cycle begins.

Utility, not novelty, will create AI winners

AI is playing a meaningful role in improving intra-company efficiency, allowing firms to enhance their own productivity and glean useful insights from ever-growing datasets. It is this opportunity, beyond a superficial AI overlay, that should allow companies embracing AI to improve, generating value through these productivity gains either directly or through increased innovation. As such, we are constructive on the opportunity set brought about by pragmatic and meaningful rollouts of AI where the goal is to support the long-term business.

The Polar Capital Artificial Intelligence Fund’s ability to invest away from headline AI enablers and into sectors beyond the remit of technology-focused funds allows us to explore these opportunities for long-term AI value creation. Not only does this allow us to stay nimble, investing in the burgeoning industries AI has yet to create, but it also gives the strategy a broader global equity footprint – again providing a differentiating characteristic compared with more traditional technology funds.

2. Agricultural facts: Summary - GOV.UK (www.gov.uk)

3. USDA ERS - Farming and Farm Income

4. Brazil - Global yield gap atlas

5. Farm Production Expenditures 2022 Summary 07/28/2023 (cornell.edu)